The Social Security System (SSS) in the Philippines is a government-run program that provides social security benefits to its members. The program is mandatory for all employees in the private sector and for some self-employed individuals. The SSS is responsible for collecting contributions from its members and using those funds to pay for benefits such as retirement, disability, and death benefits.

To become a member of the SSS, an individual must register and pay monthly contributions. The amount of the contribution is based on the member’s salary and is split between the employee and employer, with the employee typically paying a slightly larger portion. The contributions are used to fund the various benefits offered by the SSS.

One of the main benefits provided by the SSS is retirement benefits. These benefits are paid to members who have reached the age of 60 and have made at least 120 monthly contributions. The amount of the benefit is based on the member’s average salary credit and the number of contributions made. The SSS also offers disability benefits to members who become unable to work due to illness or injury. These benefits are paid until the member is able to return to work or until the disability becomes permanent.

The SSS also offers death benefits to the beneficiaries of a deceased member. These benefits are paid to the member’s legal heirs and are intended to provide financial support during the difficult period following the member’s death. In addition, the SSS also offers funeral benefits to help cover the costs of a funeral. The SSS also offers other benefits such as maternity benefits for female members who are pregnant, and sickness benefits for members who are unable to work due to illness, as well as a loan program for its members that allows them to borrow money from the SSS. The loan is based on the member’s contribution and the interest rate is lower than most commercial loans.

The SSS also provides a salary loan program for its members which is a short-term loan and the interest rate is lower than most commercial loans. There is also an existing SSS for regularly employed people in the Philippines that includes an employer contribution, but those situations are a little different and the contribution tables are set up differently. It’s not all “given”, however, as employees of all classifications are also required to contribute into their personal SSS – which has its own contribution table.

While this schedule may change year to year based on various life and domestic situations, the changes are typically minimal at best. We have documented some of these changes for 2019 and 2021, and listed the newest SSS Contribution Table for your use, should you be one of these traveling bloggers either in the Philippines, or a Filipino blogger traveling outside the country.

2022 SSS Contribution Table Chart – Compensation Guide

The SSS contribution tables below are comprehensive for most situations in the Philippines. This table is updated to reflect the most recent SSS Contribution Table change that went into effect April 1, 2022. It is possible, but not guaranteed, that this could change again in April 2021.

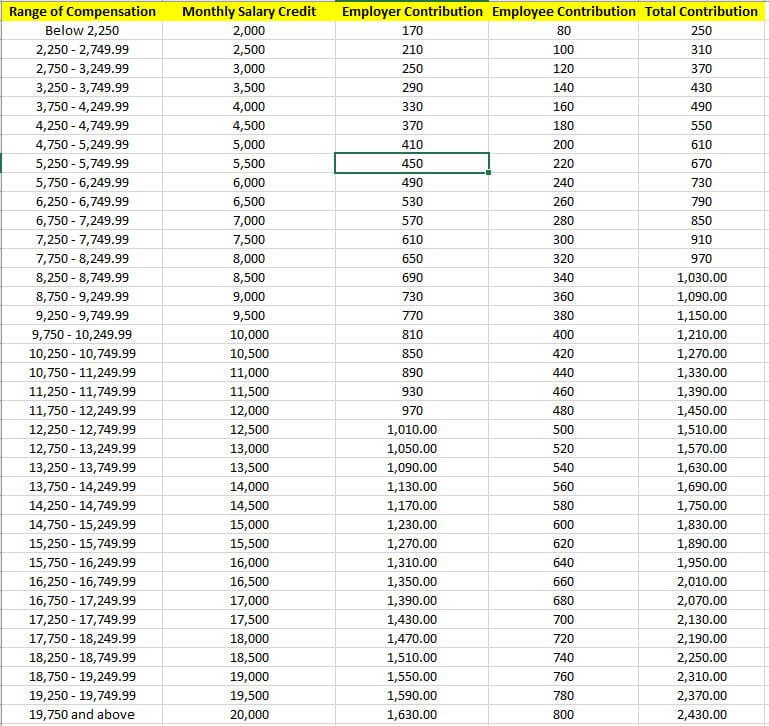

2022 SSS Contribution Table for Employed Individuals

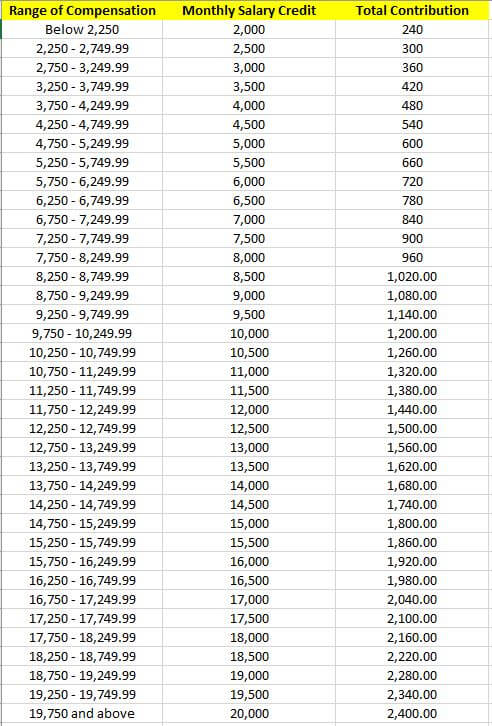

SSS Contribution Table for Self-Employed, Voluntary and OFW Members

The SSS contribution table for 2021 is located below, specifically created for those who are self-employed, voluntary, or are Overseas Filipino Workers. If you’re an OFW, the minimum monthly salary credit is P5,000.

Non-working spouses’ contribution is half (50%) of the their working spouse’s most recent monthly salary credit, with a minimum credit P2,000.

SSS Payment and Contribution Due Dates

Source of Due Date Graphic – SSS Website

Frequently Asked Questions… Answered!

- The compensation range is always calculated before taxes

- The mandatory retirement age being 65, you can contribute until that age, but not beyond.

- For the sake of accounting, you may not contribute more than what is stated on the schedule.

- Employed members who do not meet deadlines can and will face financial penalties.

- Self employed and voluntary members may make contributions monthly or quarterly. There are no other options. The deadlines for quarterly filing are at the end of the 3rd, 6th, 9th, and 12th months.

What types of benefits are eligible for self-employed bloggers and digital entrepreneurs in the Philippines?

- Sickness – Per diem relief if the benefit receiver misses work and compensation because of illness.

- Disability – If maimed or disabled, disability benefits can be paid.

- Death – Eligible compensation may be annualized or given in a lump sum.

- Retirement – Upon the age of 65, benefits are eligible to start being paid and contributions cease. This can be in installments, or lump sum.

- Funeral Grant – Compensation is eligible to those members who experience funeral expenses for a loved one or dependent.

- Maternity – Eligible women include those who had both successful and unsuccessful births.

How can you pay your SSS Contribution dues?

For those in the self-employed classification, you can visit any SSS branch and process payment over-the-counter. You can also issue these payments through the post office or your bank. Payment can be processed through Over-the-counter. The best way for this is to visit any SSS branches near your place. Payments can also be processed on accredited banks, Post office, participating bayad centers and SM business centers

Also, online transactions are now available through Bancnet and UnionBank. You can access both at the e-payment portal on the primary SSS website.